FEB 2024, Vol 21, Issue 2

Overview

- Controlling Health Care Costs

- Mental Health

- Post OSHA 300A by February 1st

- OSHA Now Prefers Safety Helmets over Hard Hats

- DOL Issues Independent Contractor Final Rule

- Time to Update Your AAPs

Controlling Health Care Costs

Organizations are bracing for higher health care costs in 2024 and expecting an increase of about 8.9%. Increasing health care costs have been an employer concern for years, and this year will be no different. Medical inflation, increased demand for weight loss drugs and the availability of new medications and gene therapies continue to drive up costs. Because employers are reluctant to pass on to their employees most of the increases they experience, managing their costs will be even more of a priority.

Employers may take different approaches to do so, from offering integrated wellness programs and telemedicine options to requiring prior authorization.

Every employer is different, and there are many approaches to controlling health care costs. Some employers may investigate value-based care by rolling out centers of excellence or additional network tiers. Some will try reference-based pricing, while others will implement stricter controls on prescription drugs. There is no one right answer, and each year seems to bring a new potential solution.

- - - -

Mental Health

Mental health has been a big focus of organizations for the past few years, and that will likely continue in the coming year. In fact, it may be a bigger emphasis due to rising rates of employee burnout and the looming presidential election, which may lead to greater employee angst and stress.

Mental health and areas around helping reduce stress and improve emotional wellness should be a massive focus for the next year.Many organizations will increasingly push available resources for employees, as well as consider new benefit offerings such as mental health days and mental health apps.

- - - -

Post OSHA 300A by February 1st

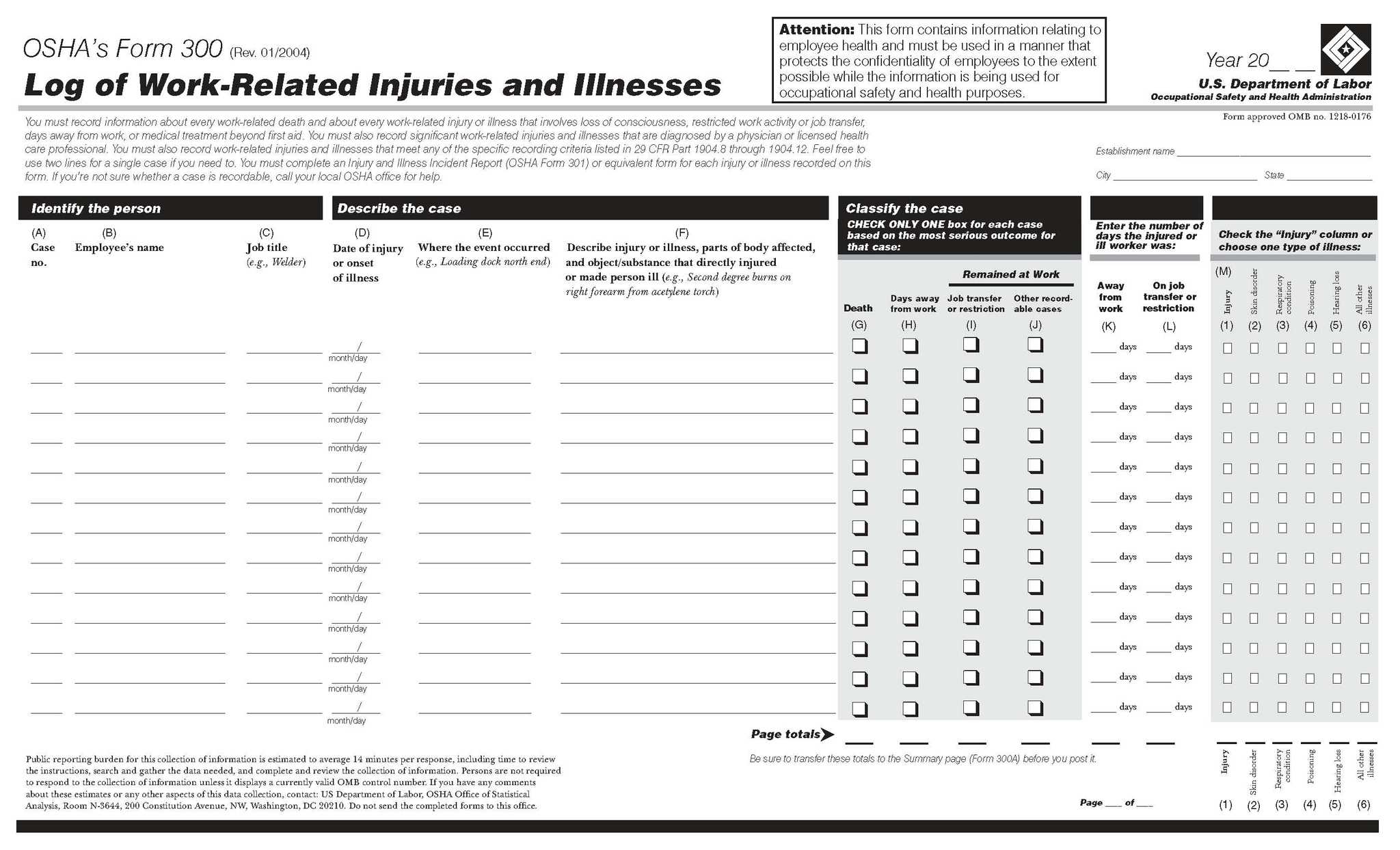

Covered employers must complete and post their 2023 annual summary of work-related injuries and illnesses by February 1, 2024, and keep it posted in a common area until April 30, 2024. All employers required to keep Form 300, the Injury and Illness Log, must utilize the annual summary Form 300A to comply with posting requirements even if there have been no recordable injuries or illnesses.

- - - -

OSHA Now Prefers Safety Helmets over Hard Hats

To better protect its workers from head injuries, the U.S. Department of Labor’s Occupational Safety and Health Administration (OSHA) announced that the agency is replacing traditional hard hats with more-modern safety helmets for agency employees.

Hard Hats vs. Helmets -Traditional hard hat design, which dates back to the 1960s, shields the top of the worker’s head but offers little protection from side impacts. As scientific understanding of head injuries has advanced, new technologies have been integrated into modern safety helmets. Helmets provide superior protection to side impacts.

According to the most recent U.S. Bureau of Labor Statistics(BLS) data, in 2021 head injuries accounted for 5.8 percent of nonfatal occupational injuries involving days away from work. Of those head injuries, 46.9 percent were due to contact with an object or equipment, and 20.5 percent were due to slips, trips, and falls. Hard hats lack chin straps, which means that if an employee trips or falls, the hat may come off, exposing the worker’s head, and increasing the risk of injury. Conventional hard hats also lack vents, trapping heat inside.

OSHA published a Safety and Health Information Bulletin titled “Head Protection: Safety Helmets in the Workplace” on its website. This Safety and Health Information Bulletin (SHIB)describes the differences between contemporary safety helmets and conventional hard hats. It also explains improvements in design, materials and protective features that contribute to the worker’s total head protection:

- Face shields or goggles to protect against projectiles, dust, and chemical splashes.

- Built-in hearing protection.

- Communication systems to enable clear communication in noisy environments.

Specifications for Protective Headgear - Hard hats and safety helmets must meet specific standards set by the American National Standard for Industrial Head Protection. Two OSHA standards detail protective headwear’s specifications.

OSHA standard 29 CFR 1910.135(General Industry) states, “The employer shall ensure that each affected employee wears a protective helmet when working in areas where there is a potential for injury to the head from falling objects and ensure that a protective helmet designed to reduce electrical shock hazard is worn by each such affected employee when near exposed electrical conductors which could contact the head.” The standard requires that they comply with ANSI/ISEA Z89.1 – American National Standard for Industrial Head Protection.

OSHA standard 29 CFR 1926.100(Construction) states, “Employees working in areas where there is a possible danger of head injury from impact, or from falling or flying objects, or from electrical shock and burns, shall be protected by protective helmets.” The standard requires they comply with ANSI Z89.1-2009 -American National Standard for Industrial Head Protection.

- - - -

DOL Issues Independent Contractor Final Rule

On January 9, 2024 the U.S. Department of Labor (DOL) released a final rule that changes independent contractors’ classification criteria effective March 11, 2024.

The final rule requires companies to weigh a variety of economic factors to determine whether a worker is an employee or an independent contractor.

The previous rule included two core factors that carried greater weight in determining the status of independent contractors, one is control over the work and the other is opportunity for profit or loss. Under this new rule, employers would use a totality-of-the-circumstances analysis, in which none of the factors carry greater weight.

The new test includes six factors:

- The degree to which the employer controls how the work is done.

- The worker’s opportunity for profit or loss.

- The amount of skill and initiative required for the work.

- The degree of permanence of the working relationship.

- The worker’s investment in equipment or materials required for the task.

- The extent to which the service rendered is an integral part of the employer’s business.

The DOL plans to release more guidance to help employers comply with the final rule.

- - - -

Time to Update Your AAPs

Many Affirmative Action Plans (AAPs) expire on December 31, 2023. Under federal law, government contractors and subcontractors with 50 or more employees who have entered into at least one contract of $50,000 or more with the federal government must prepare and maintain a written affirmative action program. AAPs must be developed within 120 days from the commencement of the contract, updated annually, and submitted to DOL during the first quarter.

- - - -

Contact HR Strategies at 302.376.8595 or "info@hrstrategies.org" if you would like support or would like to learn more about the items in this newsletter. Please contact us if you would like to be added to our Monthly Strategies mailing list.

Find more related articles:

- Health Care Costs

- Medical Inflation

- Controlling Health Care Costs

- Value Based Care

- Reference Based Pricing

- Mental Health

- Employee Burnout

- Emotional Wellness

- Annual Summary Of Work Related Injuries And Illnesses

- Safety Helmets

- Head Injuries

- Nonfatal Occupational Injuries

- American National Standard For Industrial Head Protection

- Independent Contractors Classification Criteria

- Affirmative Action Plans AA Ps